How to Make Money with Investments?

That’s a question many people keep asking.

Depending on their characteristics, investors can fall into different categories such as institutional, retail, public, and private. Investors can have different investment horizons, risk attitudes and investment objectives, but there are two things that all investors have in common: the desire to earn some return on capital and the need to protect cash holdings from the eroding purchasing power effect of inflation.

While we will certainly cover the topic of inflation in a different article, what we wish to outline today is how the retail investor has been evolving from using traditional channels to a more innovative and optimal solution for making money by investing in the financial markets. How to make money with investments is no longer a secret for some.

Table of Contents

OLD-FASHIONED INVESTOR

Historically, people who had some spare money that they wished to invest would turn to traditional investment channels: an intermediary like a bank, an insurance, or a broker they would trust. (Well… regrettably, this did not concern the past only, as most people still fall within this category nowadays.)

When it is about investing, many find it paramount to rely on a person with a physical office, who they can see, trust, and can always be held to if needed (as if that could fix poor investment decisions after they are made.)

It is always nice to have a person in front instilling a sense of concreteness and safety, but what people seem to like most is that these same intermediaries do not ask a single penny for their investment advice (however, in some instances, investors are charged upfront fees and have initial costs to bear.) This approach has several problems many people are not aware of.

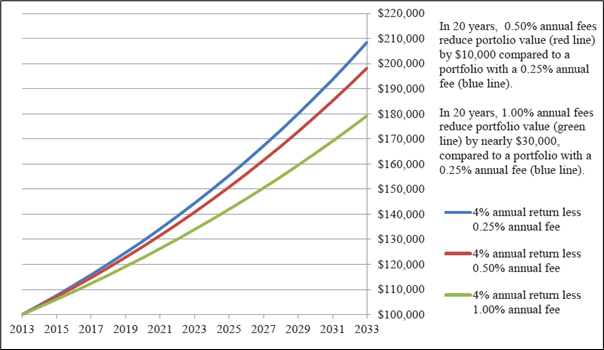

First, if nothing has been paid to the bank or broker for availing of the investment service, that does not mean that service has been given for free: banks and brokers are compensated by, among others, retrocession fees, which are basically deducted from your investment without you seeing it. Retrocession fees are nothing other than direct costs taken away from your investment as a percentage of the amount invested. There is nothing wrong with it, brokers must pay their costs too, after all, and they offer – not always the best available, but still – a service. The problem lies in the extent of the underlying, often hidden or difficult to gauge, costs; these can be, in some cases, outrageously high.

To make things worse, high fees are often coupled with poor investment vehicles.

The biggest concern, however, is that because those fees vary among different possible investments, the bank/intermediary may be brought to offer you those that generate more profit for them, leading to a clear conflict of interest between the investor and his or her intermediary.

Last but not least, a real person with a physical office and a reputable financial institution behind it is all but a guarantee that the products offered are by any means safe or fit for purpose.

By now you will have realized that investing through a traditional intermediary is far from being an optimal solution to make money investing.

For more insight about this topic, read this interesting article: How Wall Street Fools You Into Overpaying for Underperformance

MODERN INVESTOR

A growing group of people, yet the minority of investors excluding the United States, avail themselves of innovative investment providers such as independent financial advisors and/or robot advisory. Independent financial advisers are professionals who offer independent advice on financial matters to their clients and recommend suitable financial products from the whole market.

The main difference with robot advisors is the presence, as the former is a financial expert whom you can meet one-on-one. The latter is digital (with real people behind it anyway), and uses algorithmic tools, mobile apps, and digital signatures to help you invest your money.

Both of these relatively new figures are deemed independent as they are not paid by fees generated from the investments they advise.

Independent financial advisors usually earn a consulting fee for providing the portfolio strategy and may charge an annual management fee based on the client’s investment portfolio amount. Robot advisors work in the same way and, because of the increased competition, have become more competitive with their charge structure and usually do not charge initial fees but only ongoing fees based on the client’s assets under management.

Independent advisors are usually more professional and certainly more ethical. This structure resolves the conflict of interest since investors’ and advisors’ goals are aligned, but is not yet the optimal solution to make money investing.

NEXT INVESTOR GENERATION

For those individuals who like to be a little more involved with their investment assets, there is even a better alternative.

Individuals falling into this set should not utilise traditional investment channels, nor independent or robot advisory, but should choose to take advantage of investment research services like Gainshore, Zacks, SeekingAlpha, and the like.

Customers only pay a subscription plan or a fee, and there is no other cost; all the investment income goes entirely to the investor with no retrocession, management, or performance fees. It is usually possible to cancel at any time without having to liquidate the investments, which is not a possibility under other investment advice alternatives.

The reason why investment research companies are the best solution to make money investing has to do with cost savings from one side but, most of all, to a different approach used with regard to investments aimed at generating superior returns; in doing so, they take some distance from the traditional, modern theory of portfolio where (over) diversification is a must, and follow a focus investment strategy instead, a restricted selection of opportunities addressed to generate higher consistent returns.

In essence, investment research companies’ analysts use more successful investment tools and spend way more time than any other investment advisors studying, investigating, analysing and monitoring the underlying investments they recommend.

The final result for the investor going down this route is higher net returns due to lower costs and higher performance coming from a superior investment selection.

LEARN MORE ABOUT GAINSHORE INVESTMENT STRATEGY

It may seem confusing at first sight, but it is rather simple; all you need is to open an investment account, if you do not have one yet or if not already available through your bank account, and start building your portfolio with a focused selection of investment opportunities shortlisted by a rigorous approach based on Intelligent Investing. To understand how investment research works, click here.

In terms of time needed to transform your cash into investments, it takes minutes and surely less time than you would need to visit a bank or a financial advisor.

We appreciate that, for those who are unfamiliar with investments, it takes guts to sit down in front of a screen and deploy money with a click without having the assurance of doing the right thing. At Gainshore, we make sure you are properly guided and supported by real people taking good care of you and your precious hard-earned savings. Watch this video to find out why our strategy produces superior returns and proved to be more prudent than traditional investing.