Intelligent Investing key principles

There is only one way to put money to work for you and make a consistent and sustainable profit: INVESTING IN GREAT OPPORTUNITIES AND STICKING WITH THEM AS LONG AS POSSIBLE unless the underlying economic circumstances have dramatically changed.

By following a focus investment strategy, some volatility will be experienced along the way, but over time excellent investment returns will be produced.

Intelligent Investing is the only way to make superior, consistent returns while being conservative to preserve capital.

To understand why Intelligent Investing is superior to any other form of traditional investing, read these articles:

https://www.gainshore.com/portfolio-diversification/

https://www.gainshore.com/how-to-make-money-with-investments/

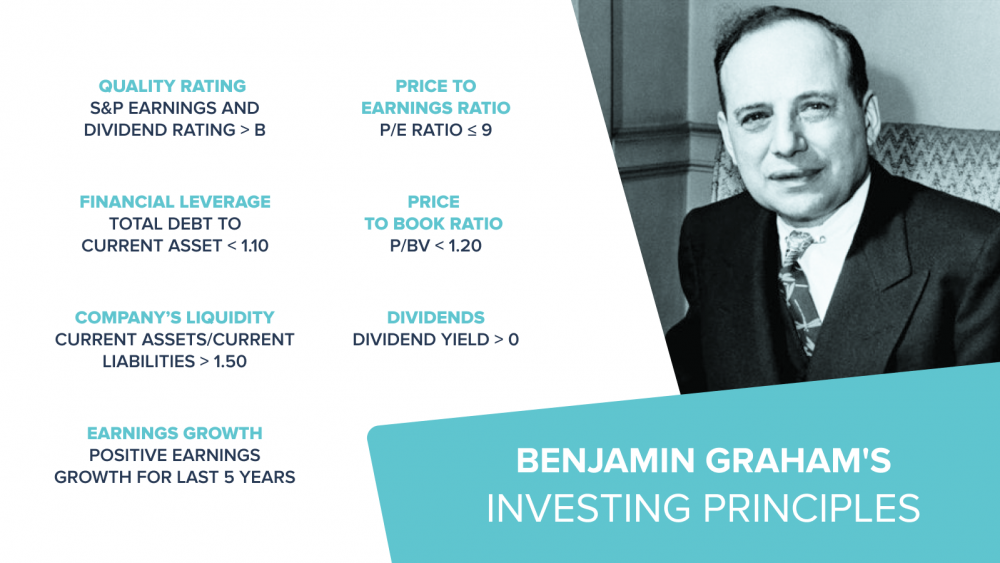

We cannot but mention one of the best quotes from Benjamin Graham, the father of intelligent investing, without whom this guide, this company, and all our life projects would not exist now:

“If you want to get wealthy in the financial markets, you’ll need to engage in hard and systematic work.”

G. Benjamin and D. Dodd, Security Analysis, 1934.

What is Intelligent Investing?

Intelligent investing is about understanding Intrinsic Value and buying an investment only if it presents a Margin of Safety.

The Investment Intrinsic Value

Warren Buffet has described intrinsic value as the price that an informed buyer would pay for the entire business and its future stream of cash.

The process of determining the intrinsic value of a business is an art form, it entails a multi-disciplinary qualitative and quantitative approach together.

The Margin of Safety

Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value.

A margin of safety is a built-in cushion allowing for some losses to be incurred without major negative effects.

“The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap). The Intelligent Investor is a realist who sells to optimists and buys from pessimists.”

Jason Zweig