What is Portfolio Diversification?

Diversification in finance means investing in several assets and investment vehicles to limit exposure to any single asset or risk.

Table of Contents

What is an Investment Portfolio?

A portfolio is a collection of financial investments like stocks, bonds, commodities, investment funds, and cash. Portfolio diversification can regard several aspects, including geography, industry, sector, asset class, etc.

Diversification is a risk management strategy whose rationale is that a portfolio constructed of different kinds of assets will, on average, yield higher long-term returns and lower the risk of any individual holding or security.

What is risk?

There are lots of different risks in the financial world: foreign exchange risk, credit risk, counterparty risk, cybersecurity risk, liquidity risk, operational risk, etc.; each of these categories include further sub-risks within, a series of real threats that every company must prevent from happening, monitor and fix in case they take place in one form or another.

However, when it comes to investing in securities, all that the financial world seems to be worried about is price volatility risk; here, diversification of portfolios comes into play.

Modern portfolio theory shortfalls explained by Warren Buffett

According to the modern portfolio theory, inherent or company-specific risks are to be minimized by diversifying a portfolio into a broad group of securities.

Volatility represents how large an asset’s price swings around the mean price, or saying it differently, how much the price fluctuates around its average. By the way, volatility computation includes swings in either direction; therefore, positive price moves contribute to higher stock volatility.

Instead, we share Warren Buffett’s different definition of risk: the possibility of harm or injury, which is a factor of the “intrinsic value risk” of a business, not the stock’s price behaviour.

Buffett’s unique view on risk also drives his portfolio diversification strategy; here, too, his thinking is the polar opposite of modern portfolio theory. According to this philosophy, remember, a broadly diversified portfolio’s primary benefit is to mitigate individual stocks’ price volatility.

Still, if the investor is unconcerned with short-term price volatility, then he will also see portfolio diversification in a different light.

“Diversification serves as a protection against ignorance,” explains Buffett. “If you want to make sure that nothing bad happens to you relative to the market, you should own everything. There is nothing wrong with that. It’s a perfectly sound approach for somebody that doesn’t know how to analyse businesses.” In many ways, modern portfolio theory protects investors who have limited knowledge and understanding of how to value a business. But the protection comes with a price. According to Buffett, “modern portfolio theory will tell you how to do average.”

If the efficient market theory is correct, there is no possibility, except a random chance, that any person or group could outperform the market and certainly no chance that the same person or group could consistently do so. Yet Buffett’s performance record for the past 48 years is prima facie evidence that it is possible, especially when combined with the experience of other bright individuals who also have beaten the market following Buffett’s lead.

At Gainshore, we analyse thousands of companies according to Intelligent Investing principles, thoroughly screen the best ones and select only the best of the BEST STOCKS and ETFs, which we constantly monitor.

We tell you WHERE WE INVEST OUR CAPITAL, and if we are wrong, you get the money back. That’s how confident we feel with our winning approach.

Discover the Best Investments For 2023 now, or subscribe to our newsletter to learn more.

What does this say about the efficient market theory? Buffett’s problem with the efficient market theory rests on one central point: it makes no provision for investors who analyse all the available information and gain a competitive advantage by doing so. “Observing correctly that the market is frequently efficient, they went on to conclude incorrectly that it was always efficient. The difference between these propositions is night and day.” Nonetheless, the efficient market theory is still religiously taught in business schools. This fact gives Warren Buffett no end of satisfaction because it allows him to earn money by implementing his security analysis tools.

It makes a lot of sense if you look at diversification from a “Do not put all your eggs in one basket” perspective. Investing your money, time, and energy in a few things is risky as you are exaggeratedly tied to the fate of the same.

In financial investments, unless you have the resources, time, passion, and expertise to study and analyse the underlying companies you invest in, obtaining a broader exposure to investments certainly reduces the risk of suffering severe losses caused by a significant investment of money gone wrong.

However, with changing perspectives, theories supporting diversification at all costs become less convincing, and one realizes that the benefits of diversification are overestimated.

For more information about portfolio diversification, read How Many Stocks Should You Own in Your Portfolio?

An example that will change the way you think of portfolio diversification

An example will clarify the concept of portfolio diversification and illustrate how security analysis and intelligent investing work in the real world.

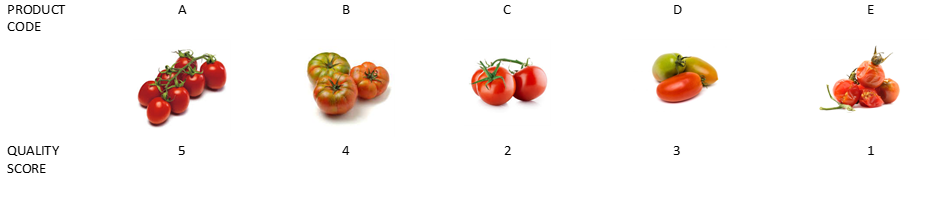

Imagine you are in a grocery store, you want to buy a few pounds of the best tomatoes, and there are the following choices:

You have guests at home that you can not disappoint. They come from abroad and wish to taste the best, testier, and more genuine local tomatoes; what would you do? You’d probably trust instinct or your senses like sight or smell, or maybe, you would buy the more expensive ones to be sure. You could alternatively try to ask the store owner, hoping to find a person who knows what the best tomatoes are but who guarantees that his opinion is sincere and does not lead us to buy what he should get rid of?

Now let’s go back for a moment and suppose that you are lucky enough to find yourself in the shop with a trusted friend who is also an expert in the field and knows in detail the quality and flavour of each of the varieties of tomatoes on sale. He has tried all of them in person and knows the producers and the quality of the products; he also had the tomatoes analysed to check for nutrients and the presence of any other substance and evaluate whether one or more varieties derive from strict organic farming.

Following his analysis of tomatoes available in the shop, he provides his overall quality score (from 5 maximum to 1 minimum), combining the underlying quality and taste of each tomato variety as follows:

Can we now make an optimal decision or at least increase the odds in our favour? Most likely, yes: definitely not buying all varieties just to reduce the risk that your guests will not be happy with your tomato salad.

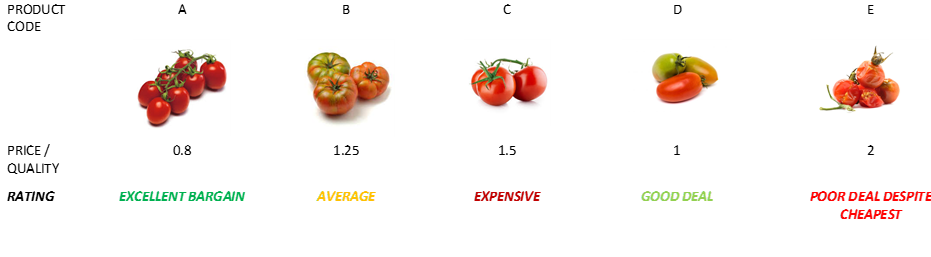

With this data available, one key measure that could assist in the buying process is the Price / Quality Score measure. This is precisely what stock-picking investment researchers like Gainshore do when providing stocks and funds ratings.

Tomatoes with the lowest Price/Quality ratio represent the best choice. An intelligent shopper should buy type A tomatoes, a little of D could also make sense and disregard all the others.

Imagine doing the same with everything you eat (or buy in general), and you would get what we call intelligent diversification, achieving the best results for your health and wallet simultaneously.

This is yet a simplistic example, and it takes into account one parameter only, while in the real world of security analysis, there are plenty of considerations to make; however, it hopefully illustrates the concept.

Findings and analogies with security analysis and intelligent investments

- The best choices are usually not the most expensive ones

- Poor alternatives are not always cheap

- Great opportunities are challenging to find and require effort and knowledge.

Conclusions about portfolio diversification

Build a broadly diversified investment portfolio if you don’t have the chance to delve into the underlying investments you buy. You will get the so-called average market result by ensuring you are not too concentrated on investments that may turn out to be wrong.

Alternatively, if you wish to achieve an above-average market return, focus your efforts on analyzing the available investments or rely on specialized experts who make this work their daily profession.

Gainshore discovers the most solid and profitable business opportunities available worldwide, a strategy that proved to be superior and more conservative than traditional investing.

SEE MORE ABOUT GAINSHORE INVESTMENT STRATEGY

Become a business owner and start earning without having to work. START YOUR INTELLIGENT DIVERSIFICATION TODAY