Mutual Funds

Mutual Funds are a ready-made basket of investments. When you invest in funds, you’re buying into a mix of assets, which may include shares, bonds, property, and cash.

Mutual funds are pooled investment vehicles that collect money from many investors and invest it in several securities such as stocks, bonds, commodities, other funds (funds of funds), and other assets, according to the fund’s investment strategy and permitted investment policy.

The combined holdings of the mutual fund are known as its portfolio.

Mutual funds are managed by asset management professionals, the investment management company, which is run similarly to any other firm and thus faces many expenses, from personnel to equipment, electricity, rent to transaction costs etc. Some of these costs are borne by the company, some by the fund, and ultimately by the investor.

Mutual funds’ expenses are usually higher than other funds, like index funds or ETFs, since they include, amongst others, a management fee for pursuing an actively managed strategy, as in the research and selection of what assets to purchase and when to get rid of them.

Investors buy shares or units in mutual funds; each share represents an investor’s part ownership in the fund and the income it generates.

There is a long debate as to whether the higher expense ratios of mutual funds are counterbalanced by higher returns for investors. Sadly, many mutual funds turn out to be following a rather passive strategy and underperforming similar investment alternatives; mutual funds’ expenses are, in many cases, a drag to the investors’ returns.

Understand the difference between Mutual funds and Pension funds here.

Judging an active fund’s performance can be quite cumbersome and requires expertise, read more in this article.

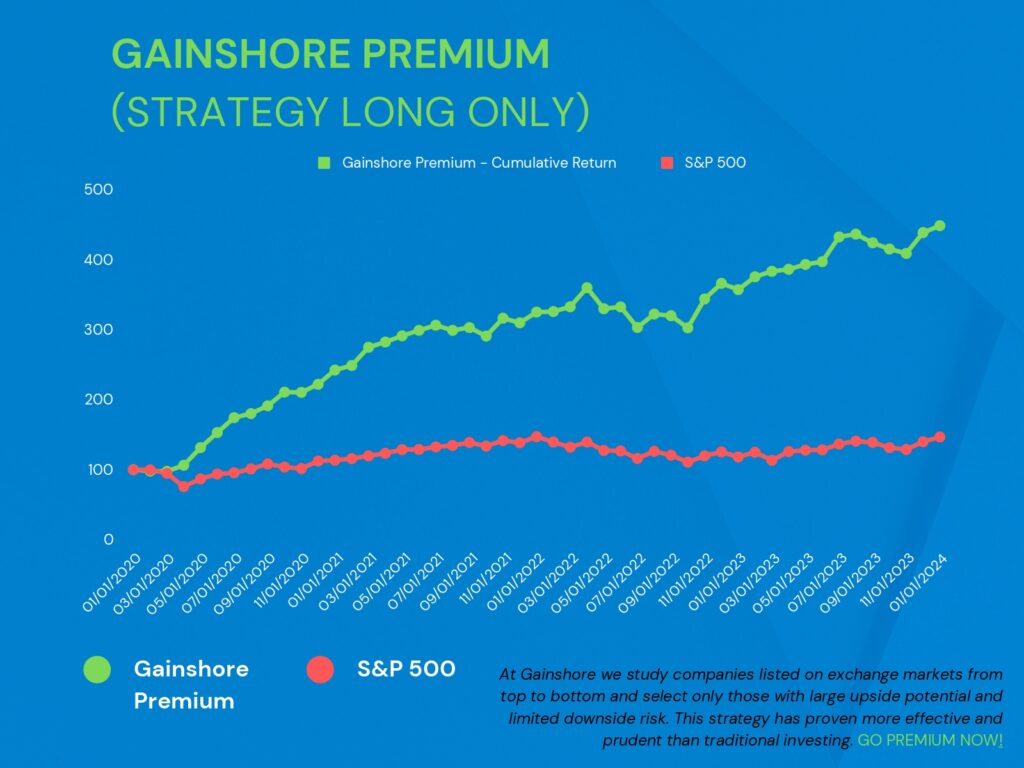

Finding the best portfolio managers is not an easy task. However, there are excellent active funds that consistently deliver outstanding returns under diverse market conditions for many years.

Go BASIC and discover the best mutual funds and ETFs according to Gainshore.