Are you tired of seeing your hard-earned money sitting idle in a savings account, earning minimal interest? Are you ready to take control of your financial future and make your money work for you? If so, you’ve come to the right place.

In this fast-paced world of investing, it can be overwhelming to know where to put your money for maximum returns. But fear not, because we’re here to help you unlock the secrets of wise investments. Whether you’re a seasoned investor or just starting out, our expert advice will guide you through the maze of investment options, helping you make informed decisions that will yield significant returns.

From stocks and bonds to real estate and cryptocurrencies, we’ll explore the pros and cons of each investment avenue, giving you the tools you need to diversify your portfolio and achieve financial success. Get ready to embark on a journey towards a brighter financial future – let’s start unlocking those investment secrets today!

The Importance of Wise Investment Decisions

Making wise investment decisions is crucial for achieving financial success. Your hard-earned money should not be sitting idle in a low-yield savings account. By investing in the right avenues, you can grow your wealth and maximize your returns. However, it’s important to remember that investing always involves risk. The key is to understand the relationship between risk and return and make informed decisions based on your financial goals and risk tolerance.

When it comes to investing, it’s crucial to have clear financial goals in mind (read also www.gainshore.com/is-now-a-good-time-to-invest). Are you saving for retirement, a down payment on a house, or your children’s education? Knowing your goals will help you determine the appropriate investment strategies and time horizon. It’s also important to consider your risk tolerance. Are you comfortable with the ups and downs of the stock market, or do you prefer more stable investments? Understanding your risk tolerance will help you choose the right mix of investments that align with your comfort level.

Understanding Risk and Return

Risk and return go hand in hand when it comes to investing. Generally, investments that offer higher returns also come with higher risk. This means that while you have the potential to earn significant profits, there is also a greater chance of losing money. On the other hand, investments with lower risk tend to offer lower returns. It’s important to strike a balance between risk and return that matches your financial goals and risk tolerance.

One way to assess the risk of an investment is by looking at its historical performance. How has the investment performed in the past? Has it experienced significant fluctuations in value, or has it been relatively stable? Another factor to consider is the investment’s volatility. Volatility refers to the degree of price fluctuations over time. Investments with high volatility are more likely to experience large price swings, while those with low volatility tend to have more stable prices. Understanding these factors will help you gauge the risk associated with different investment options.

Different Investment Options

Now that we understand the importance of wise investment decisions and the relationship between risk and return, let’s explore the various investment options available to you. Each investment avenue has its own set of pros and cons, and it’s important to consider your financial goals, risk tolerance, and time horizon when deciding where to allocate your money.

Stocks: Investing in the Stock Market

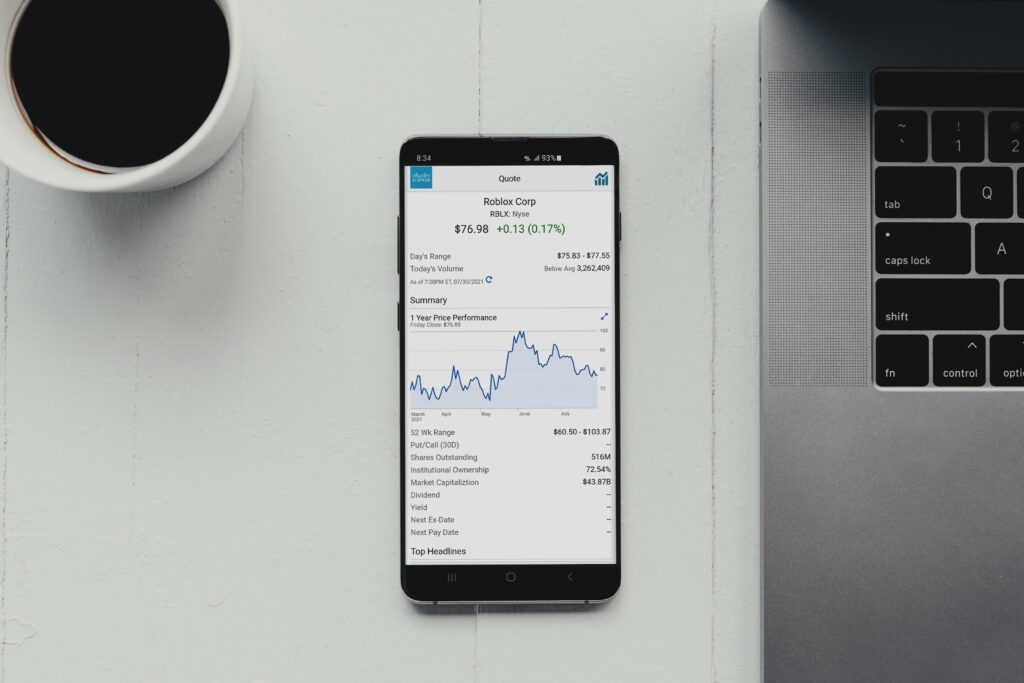

Investing in stocks is one of the most popular ways to grow your wealth. When you buy a stock, you become a partial owner of the company, and your investment grows as the company’s value increases. Stocks offer the potential for high returns, but they also come with higher risk. The stock market can be volatile, with prices fluctuating daily. It’s important to research and analyze individual companies before investing in their stocks. Diversifying your portfolio across different industries and market sectors can help reduce risk.

Bonds: The Benefits of Fixed Income Investments

Bonds are fixed income investments where you lend money to a government or corporation for a fixed period in exchange for regular interest payments. Bonds are considered safer than stocks because they offer a fixed return and are less affected by market fluctuations. They are a good option for conservative investors looking for stable income. However, the returns from bonds are generally lower than those from stocks.

Real Estate: Investing in Properties for Long-Term Returns

Investing in real estate can provide both income and long-term appreciation. Whether it’s residential, commercial, or rental properties, real estate can be a lucrative investment option. Rental properties generate passive income through rental payments, while property values tend to appreciate over time. However, investing in real estate requires careful research and due diligence. It’s important to consider factors such as location, market trends, and potential rental income before making a purchase.

Mutual Funds: Diversifying Your Investments for Stability

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities. They offer instant diversification, making them a popular choice for beginners. By spreading your investment across multiple assets, mutual funds help reduce risk. They are managed by professional fund managers who make investment decisions on behalf of the investors. However, it’s important to research the fund’s performance and fees before investing.

Exchange-Traded Funds (ETFs): Combining the Benefits of Stocks and Mutual Funds

Exchange-Traded Funds (ETFs) are similar to mutual funds but are traded on stock exchanges like individual stocks. They offer the diversification benefits of mutual funds and can be bought and sold throughout the trading day. ETFs track specific indexes or sectors, allowing investors to gain exposure to a wide range of assets. They are typically more cost-effective than mutual funds and offer greater flexibility.

Investing in Precious Metals: Gold, Silver, and Other Commodities

Investing in precious metals like gold and silver can provide a hedge against inflation and economic uncertainty. Precious metals tend to retain their value over time and are considered safe-haven assets. They can be purchased in physical form or through exchange-traded products. However, it’s important to note that the prices of precious metals can be volatile, and their returns may not always match those of other investment options.

Cryptocurrencies: The Risks and Rewards of Digital Currencies

Cryptocurrencies like Bitcoin and Ethereum have gained significant attention in recent years. They offer potential for high returns, but they are also highly volatile and can be risky. Cryptocurrencies operate on blockchain technology and are not regulated by any government or financial institution. Investing in cryptocurrencies requires careful research and understanding of the technology. It’s important to only invest what you can afford to lose and consider diversifying your investments across different cryptocurrencies.

Seeking Professional Advice: Financial Advisors and Investment Research

If you’re unsure about making investment decisions on your own, it may be wise to seek professional advice. A financial advisor or investment manager can help you create a personalized investment strategy based on your financial goals, risk tolerance, and time horizon. They can provide valuable insights, recommend suitable investment options, and help you navigate the complexities of the investment landscape. However, it’s important to choose a reputable advisor or manager and review their track record and fees.

If you are in step with the times and are able to use a personal computer there is even a better alternative: to learn more read www.gainshore.com/how-to-make-money-with-investments

Developing an Investment Strategy: Balancing Risk and Return

Once you’ve explored the various investment options and sought professional advice if needed, it’s time to develop your investment strategy. This involves determining the appropriate mix of investments that align with your financial goals and risk tolerance. A well-diversified portfolio consists of a mix of different asset classes, such as stocks, bonds, real estate, and commodities. Diversification helps spread risk and maximize returns. It’s important to regularly review and rebalance your portfolio to ensure it remains aligned with your investment strategy.

Monitoring and Adjusting Your Investments

Investing is an ongoing process that requires regular monitoring and adjustment. It’s important to stay informed about market trends, economic factors, and changes in the investment landscape. Monitoring your investments allows you to identify potential risks and opportunities and make necessary adjustments to your portfolio. However, it’s important not to make impulsive decisions based on short-term market fluctuations. Instead, focus on your long-term financial goals and stick to your investment strategy.

Conclusion: Making the Most of Your Investment Opportunities

Unlocking the secrets of wise investments is the key to achieving financial success. By understanding the importance of wise investment decisions, the relationship between risk and return, and the various investment options available, you can make informed choices that will maximize your returns. Remember to consider your financial goals, risk tolerance, and time horizon when deciding where to allocate your money. Seek professional advice if needed and develop a well-diversified investment strategy. Regularly monitor and adjust your investments to ensure they remain aligned with your financial goals. With the right knowledge and approach, you can unlock the potential of your hard-earned money and pave the way towards a brighter financial future. Start investing wisely today!

DO YOU WISH TO GENERATE PROFITS WITH YOUR SAVINGS BUT LACK TIME OR PROFESSIONAL EXPERTISE?

Do not take unnecessary risks, try Gainshore now – Satisfied or Guaranteed.

SOURCES

This article was written with the help of Artificial Intelligence thanks to the AI Writer 2.0 tool.