What is investment research?

Investment research is the process of analysing and evaluating potential investments to make informed decisions.

Investment research involves gathering information about companies, industries, markets, economic and social trends to assess an investment’s potential risks and rewards. It also involves analysing financial statements, assessing the competitive landscape, and evaluating macroeconomic and microeconomic factors.

The ultimate goal of investment research is to discover investment opportunities and highlight potential risks to be monitored.

Research usually entails studying and scrutinizing more than one investment simultaneously. An analysis of a group of similar activities (peers) is advantageous for at least two reasons:

1. The analysis of an entire sector or industry, for example, provides much more insight than a study of a single company operating in that sector or industry. Understanding how the market is going, what are the threats, the opportunities, the existing and upcoming technologies, the competitive environment (potential of new entrants into the industry, power of suppliers and customers, and threat of substitute products, see Porter 5 forces), knowing competitors’ moves, allow having a much more complete picture of each underlying investment opportunity.

2. A detailed comparison of similar assets simultaneously assists in the process of estimating the fair value or intrinsic value of an investment, thus helping to determine whether an investment is undervalued, overvalued or fairly valued and shed light on price anomalies and market inefficiencies.

TABLE OF CONTENTS

Advantages of investment research

How to use investment research

Best sites for investment research

Methods of investment research

Advantages of investment research

Investment research can provide investors with the information and insights they need to make informed investment decisions. Investment research can help investors identify opportunities, assess risks, and develop strategies for achieving financial goals. Investment research can also help investors understand financial markets and stay up-to-date on the latest developments in the industry, which can help them make better decisions.

Ultimately, investment research can help investors maximise returns while minimising risks. Not an easy task!

Here is a summary of the benefits of investment research:

1. Improved Investment Decisions: Investment research can help investors make more informed decisions. It can provide valuable insights into the risks and rewards associated with different investments and the potential for long-term growth.

2. Increased Returns: Investment research helps identify investments with the highest potential returns, thus maximising savings in the long term.

3. Reduced Risk: Investment research can help investors identify investments that offer the lowest risk. This can aid in minimising risk exposure and preserving capital.

4. Diversification: investment research contributes to smart portfolio diversification. This, in turn, can help reduce risk and increase long-term returns.

5. Market Insights: Investment research can provide investors with a valuable understanding of the current market environment, enabling informed investment decisions.

How to use investment research?

Doing research before investing is essential to making informed investment decisions. All investments carry risk, and research can help manage it. In addition, it is crucial to stay up to date about your investments and the markets to decide to hold, sell or buy more.

Investment research companies manage all this, discovering and monitoring a universe of investments for their clients.

While investment research has for centuries been a privilege reserved for large or institutional investors, today, there are several websites accessible online even by small savers.

Investment research companies assign a grade, score, or, most often defined as a rating (not to be confused with credit rating), to each investment they have studied thoroughly. The rating usually goes from A (the best) to E (the worst).

Depending on the details provided, the stock or fund rating may be accompanied by reports, charts, financial data, or just brief descriptions of the investment and the investment thesis.

Standard steps to use investment research

What seems long to read actually takes only a few minutes.

1. First of all, it is essential to have a broker account or an investment platform from where you can operate on your own; often, you can also invest through your bank account. Alternatively, there are plenty of options available online and opening one is very easy (check out the 5 best investment platforms for 2023 here).

2. Once you have registered and logged in to the website of our research company, you will need to sort or filter the best investments, those with the highest ratings or ratings. Often this ranking is already done automatically within specific sections of the site, usually referred to as “best stocks to buy” or “best ETFs”.

Those who wish, before investing on a specific stock or fund, can carry out their own research and go deeper by reading the information on that specific investment available on the research platform.

3. The most entertaining step is building the investment portfolio. Part or all of the liquidity available on your investment account is now to be allocated in some or all of the best-selected investments, according to personal preferences or suggested weightings (1% of the total, 3%, 5%, etc.)

The more concentrated the portfolio, ie. the higher the allocation percentages, the greater the potential for profits and losses.

The same principle applies to those who already have an investment portfolio but wish to rebalance or invest more money in different securities.

Another useful service for portfolio construction is the so-called model portfolios, a combination of investments grouped together to achieve specific risk-returns targets. The preferred model portfolio can simply be copied along with the suggested weighting for each asset in the portfolio.

4. Once the investment portfolio is built, investment research users do not have to worry about monitoring or checking anything; that’s the beauty of investment research. Investments should be held until the underlying circumstances have changed or the investment has reached its full potential. Here investment research companies come in handy in two ways:

By sending a notice (alert) of purchase or sale – usually via newsletter – explaining the reasons behind the updated position on the investment and the recommended action to be taken (sell, buy, buy more),

Providing an indicative price from the outset to exit the position if it rises too high (take profit) or if it falls too low (stop loss); this method is more suitable for short-term speculative investments.

Before investing, savers should always consider their risk attitude, investment goals, and investment horizon.

Best sites for investment research

We tried almost every independent investment research website available in the world.

Here we will list only those who we think are the best, along with their pros and cons.

| Website | Logo | Pro | Cons | Price* range |

| www.gainshore.com |  | The only investment research that requires no time or financial expertise. Focused on high-added value qualitative analysis. Free full support and user-friendly approach. | Not the best solution for experienced investors who want to spend time doing their own research. | €199 – €999 Including performance guarantee** |

| www.seekingalpha.com |  | Best for experienced investors looking to gather investment opinions and quantitative information. | Not suitable for people who want to spend little time managing their investments or do not have financial experience. Qualitative rating is not always reliable. | $199 – $499 Including performance guarantee |

| www.zacks.com |  | Its proprietary earnings surprise service is suitable for speculation and short-term investments. | It seems to lack qualitative analysis or long-term-oriented research, as ratings change too often. | $249 – $2995 Including performance guarantee |

| www.valueline.com |  | The most aligned to the concepts of Intelligent Investing. Reports incorporate tables of very useful and hard to find data. | Not suitable for people who have no time or financial experience. | $199 – $795 |

| www.alphaspread.com | Among the most reliable quantitative research sites that include, in the main dashboard, the calculation of the intrinsic value of each stock. Includes non-American shares. | Suitable for experts only. | $180 – $2400 |

**The most serious investment research firms repay their clients in full should their investment recommendations have a lower weighted return than the benchmark.

Methods of investment research

Investment research methods converge into two different main types: technical analysis and fundamental analysis.

Technical Analysis

Technical Analysis is a form of security analysis that uses various indicators to examine price and volume data displayed graphically in charts in order to predict the direction of prices in the future.

Several websites, such as www.investing.com, as well as most online brokers, provide free technical analysis signals based on algorithms or surveys between traders.

While technical analysis can be helpful in some respects, studies have shown several limitations. In general, the benefits of technical analysis are not comparable to fundamental analysis, to which we will devote much more attention.

Fundamental Analysis

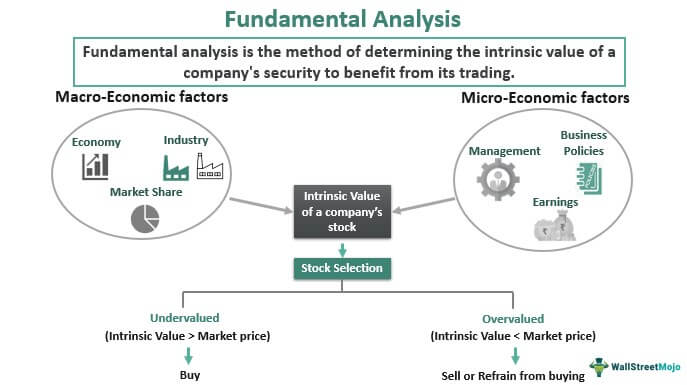

Fundamental analysis (FA) refers to the process of studying the intrinsic or fair value of securities in order to find the best opportunities to make profits. The main purpose of fundamental analysis is to determine whether a security is undervalued, valued correctly, or overvalued and thereby make an informed decision to maximize earning potential: buy, refrain from buying, or sell.

Warren Buffet has defined intrinsic value as the price an informed buyer would pay for the entire business and its future cash stream.

The process of determining the intrinsic value of a business is an art form; it entails a multi-disciplinary qualitative and quantitative approach together.

Margin of safety is a principle of intelligent investing in which investors only purchase securities when their market price is significantly below their intrinsic value. A margin of safety is a built-in cushion allowing some losses to be incurred without significant adverse effects.

Quantitative vs Qualitative analysis

Quantitative analysis measures quantitative data and uses numerical-based metrics, such as formulas, financial ratios, percentages, and statistics.

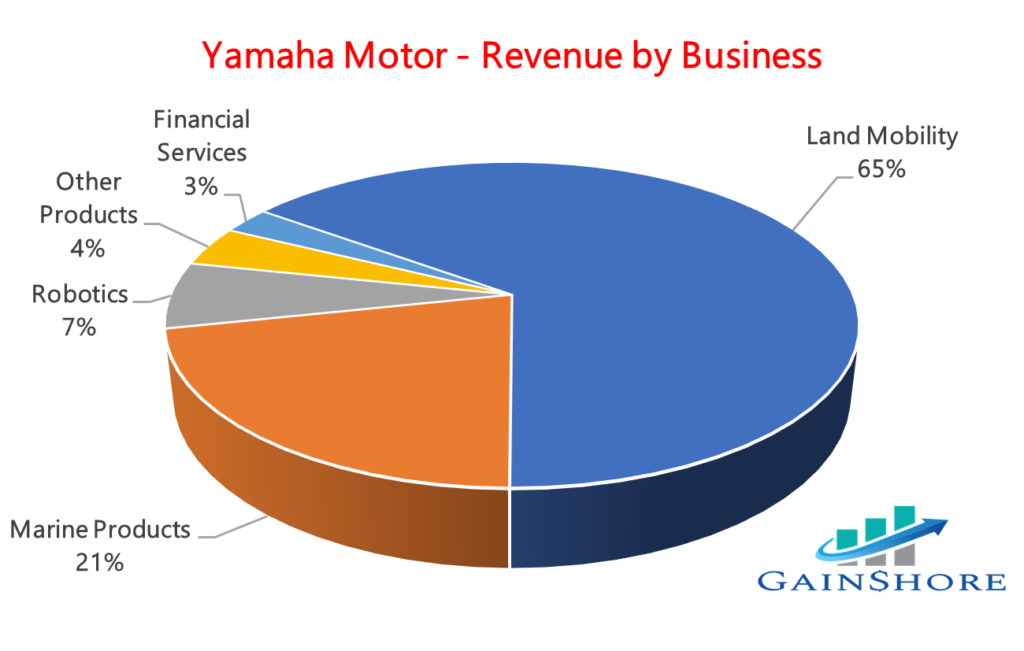

Calculating a company’s revenue and operating income by business is an example of quantitative analysis.

In stock research (equity research), quantitative analysis involves examining years of companies’ reports and financial statements – profit & loss, balance sheet, cash flow statement, and notes to the financial statements – to ultimately gauge the growth prospect and the companies’ health with regards to the following dimensions:

- Growth (sales, gross profit, cost of sales, operating expenses, R&D, operating income, earnings, etc.)

- Profitability (margins, return on capital, etc.)

- Short-term liquidity and Long-Term Solvency (cash, inventory, receivables vs short-term liquidity, debt burden, leverage, interest coverage, etc.)

- Cash flow generation and income quality (cash from operating, investing, and financing activities, changes in working capital, investment in capital equipment, mergers & acquisitions, etc.)

- Efficiency (asset turnover, cash conversion cycle, etc.)

- Operating risk (break-even point, operating leverage)

- Valuation (relative and intrinsic valuation, multiples trend).

Qualitative analysis, on the other hand, can be described as the process of going beyond the results of quantitative analysis to investigate more detailed aspects of the business and the sector to which it belongs.

Qualitative research involves, amongst other things, the analysis of competition (Porter 5 forces, SWOT analysis, and the like), consumer and competitor behaviour, industry performance, management and company policies, together with a focused investigation of the items flagged for review during the quantitative analysis.

Financial models, algorithms, and artificial intelligence can be of great help in investment research, but they will never be able to add the same value as qualitative analysis.

Qualitative “manual” analysis makes a difference when taking informed investment decisions, mainly for two reasons:

- The essential fact is that investment analysis requires personal interpretation and interconnections with different disciplines that go beyond numbers and economics.

- Accounting is not a science. Accounting standards are established criteria and rules for financial statements to reflect the economic position of an organisation as reliably as possible; however, in practice, the application of accounting rules has a wide degree of subjectivity, judgment and interpretation. With accounting, there is no cause-and-effect relationship.

Philosophy is like being in a dark room and looking for a black cat.

Metaphysics is like being in a dark room and looking for a black cat that isn’t there.

Religion is like being in a dark room and looking for a black cat that isn’t there and shouting, “I found it!”

Science is like being in a dark room looking for a black cat while using a flashlight.

Unfortunately, many analysts rely more on quantitative rather than qualitative research. Moreover, by using techniques that rely on forward projections, they risk being misleading because these are based on too many assumptions and estimates.

Gainshore is one of the few companies putting real people and qualitative research before AI and quantitative methods; that’s the formula for our success.

Fundamental analysis examples

Investing blindly in stocks without conducting fundamental analysis may result in significant losses; although most people associate financial crashes with the dot-dot-com bubble of 2008-09, examples of overvalued investments that burst and plummet in a frightening way happen frequently.

Rivian Automotive is a clear example of the risks of ignoring fundamental analysis. Rivian Automotive is an American manufacturer of electric vehicles famous for its SUVs and electric pickups that can be adapted to customer specifications, such as Amazon (with which Rivian is in partnership).

The company went public through an Initial Public Offer (IPO) in November 2021 (read more about IPO stocks to understand why never invest in IPOs). 153 million shares were sold at an initial offering price of $78.00, valuing the company at $66.5 billion. On its first trading day, the stock closed at $100.73 per share to reach $170 in the following days, valuing the company more than $150 billion, more than the value of Ford, Volkswagen and Fiat-Chrysler (Stellantis) put together, while Rivian was loss-making (it is still at the time of writing) and its sales were only about 3% of Ford sales and 2% of Volkswagen.

No surprise, the company shares have lost more than 90% of their value ever since, leaving its early investors with a bunch of pennies on the dollar.

Investment fund research

In summary, investment fund research allows users to discover the best funds available within a specific category (for example, Asian equities or high-yield bonds) and to exclude funds that have historically performed worse due to poor investment management, higher costs or other reasons.

Investment fund research revolves around the study of funds, mainly actively managed mutual funds and ETFs, to assess the best available investment schemes among similar options.

This is the work that financial and robot advisors – like Money Farm – (should) do, assuming they provide independent investment advice. Banks and conventional advisers – i.e. not independent – instead limit themselves to offering their home brand products or those who pay them the highest commissions. Unfortunately, the vast majority of people in the world still rely on the latter, read this article to learn more.

We will describe the process and provide some examples to show what fund research is about.

1. Initial Filtering

Let’s suppose we want to search for the best funds investing in European shares, and we have several options that we can choose from our investment platform.

To be sure to compare apples with apples, the starting point is to ascertain that our group of funds for comparison has a similar investment strategy, invests in the same asset classes (European equity in our case), and follows the same benchmark (e.g. the Euro Stoxx 50.)

To confirm that we are on the right track, the easiest thing to do is to look for the most recent fund fact sheet, the KIID, or the memorandum to check the investment strategy description and benchmark. Suppose we are always looking for a European equity fund, for example. In this case, we will ignore any fund that may invest in global stocks, Asian convertibles or corporate bonds, for example. To take it a step further, in the fund’s or KIID’s information sheet, we could take a look at the investment portfolio data and charts that illustrate the geographical, sectoral, main actions, etc. and compare them to the group of funds we’re analyzing.

Finally, we could look at the fund’s risk level, which usually ranges from 1 (minimum) to 7 (maximum): these metrics are mainly based on the volatility of returns. If the funds’ risk levels differ by more than one digit, this may indicate a different investment strategy or a very comprehensive index (this frequently happens with fixed-income funds), a limit that must be considered when undertaking investment fund research.

2. Historical Track Record

Once we are satisfied with the first skimming, we will realize that some of the funds are longer since they were launched before others.

The track record length is something to consider. Theoretically, funds with a longer history shall be preferred over funds with a short track record; this is particularly true for alternative funds, many of which fail – have shown several research – at the first down business cycle.

A longer track record also gives more assurance about the results’ consistency.

3. The extra yield – Alpha

The most critical point, especially for actively managed funds, is assessing the fund manager’s ability to generate higher net returns, the so-called Alpha. So, if Fund A and Fund B have the same strategy and cumulative performance of 20% and 15% between January 2020 and December 2022, is A the best fund? Not necessarily, it’s not that easy.

The performance of the funds is also influenced by the so-called Beta, the volatility of the fund’s portfolio compared to the market (our benchmark). The Beta indicates the sensitivity between the fund and the benchmark; by definition, the beta of the benchmark is 1. In theory, securities with Beta > 1 fluctuate more than the benchmark, both upward and downward. In contrast, stocks with < 1 in Beta show lower volatility than the benchmark as a whole.

Returning to our example, if the fund’s A portfolio performed better simply because it had a Beta higher than B of the fund, it could mean that Fund A beat Fund B solely because it took more risks than B; so A may not be the optimal choice from a risk-adjusted return perspective. The key metric to search for, Alpha, disaggregates the Beta factor with respect to the underlying performance, highlighting the extra yield generated on the same index not due to the Beta factor.

An Alpha of 5 means that the investment outperformed its 5% benchmark. An Alpha of -1 means that the investment has underperformed its benchmark index by 1%. If the alpha is zero, its performance corresponds to the benchmark.

A fund with a higher net Alpha is preferable to a fund with a lower net Alpha, even if the latter has a lower expense ratio (see more below.)

If an actively managed fund with a gross alpha lower than its expense ratio, it is more optimal to invest in an ETF or index fund following the same strategy (see more here).

Sharpe Ratio, Sortino Ratio and Information Ratio

Three popular measures to ensure that performance is risk-adjusted are the Sharpe ratio, Sortino and Information Ratio. The higher the coefficient, the better.

The Sharpe ratio represents the return on the portfolio beyond the return on the risk-free rate (risk-free rate), divided by the standard deviation of the portfolio (square root of volatility).

The Information ratio differs from the Sharpe ratio in that it has to the numerator the difference between the return of the portfolio and the return of the benchmark. The denominator of the Information ratio is the so-called tracking error, the volatility of returns in excess of the benchmark. A low tracking error means that the portfolio consistently beats the index over time. A high tracking error means that portfolio returns are more volatile over time and do not exceed the benchmark consistently.

While the Sharpe and Information ratio compare returns with the volatility of these returns, the Sortino ratio only considers the negative volatility, hence is a much better parameter to refer to.

Based on CAPM and the modern portfolio theory, these parameters have several limitations in the real world. One of the most important drawbacks is that both Alpha and Beta are historical measures of past performance, as well as volatility. Another problem is that the latter is always considered unfavourable despite the fact that the volatility formula itself includes negative but also positive movements in the price of securities relative to the average.

Intelligent Investing goes beyond the severe limitations of modern portfolio theory, taught throughout the world’s economics universities as the Gospel.

4. Fund Expenses

Investment managers have expenses to face when running a fund.

The so-called Total Expense Ratio (TER) – mandatorily disclosed within the fund’s documents, expresses the annual total cost in percentage of the assets under management (AUM) for each unit class of the fund (retail classes reserved for small investors are usually more expensive than institutional classes because their size is smaller, they also pay higher retrocession fees to banks and non-independent consultants.)

The TER comprehends the management fee, marketing costs, transaction charges, depositary fees, etc.

A lower TER is preferred to a higher TER, but as explained earlier, it shall not be the first parameter to look at when comparing mutual funds.

TER ratio is more relevant when comparing ETFs, but there are equally important features to consider (more information below).

5. Turnover Ratio

The turnover ratio indicates the frequency of purchase and sale transactions within the fund’s portfolio.

One of the principles of Intelligent Investing is to pursue a low turnover ratio.

Low turnover means higher net returns thanks to lower transaction fees and minimised taxes (since no capital gains tax is owed until the securities are sold, if the gain is left in place, money compounds more forcefully). Moreover, a portfolio manager with a low turnover ratio could be indicative of sound investment decisions, taken only after lengthy research and analysis, as the investment thesis of the best long-term investment opportunities rarely changes.

Investment fund research specifics for ETFs

Replication methods

ETFs replicate or “copy” a particular benchmark or index, a basket of securities grouped according to some characteristics they have in common, such as their sector, geography, or market capitalisation.

ETFs can have two methods of replication:

Physical replication: the ETF effectively invests and holds the underlying securities according to the index weighting.

Synthetic replication: the ETF enters into a derivative product (swap) mimicking the index’s results. The derivative contract is concluded with a bank, so this type of replication presents counterparty risk.

Physical replication is to be always preferred over synthetic replication.

Bid-Ask Spread

ETFs trade like stocks in regulated exchange markets and, like any exchange-traded securities, have bid and ask prices, representing the quotes to which buyers and sellers are willing to exchange units of that specific ETF.

Wider spreads mean higher costs for investors and can be symptomatic of lower liquidity.

Investors shall always give preference to ETFs with narrow bid-ask spreads.

Underlying liquidity

Investors should choose funds that invest in highly liquid indices to avoid stressful situations in the event of market turbulence.

Tracking Error

The goal of ETF funds is to track an index.

ETFs that can best replicate the index they invest in have lower tracking errors and are preferred.

ETF provider

The ETF provider’s reputation is another aspect to consider when selecting an ETF.

Two main shortfalls of Investment Research

1. Knowing everything about one investment does not guarantee knowing everything about that investment… There may be several reasons why an investment thesis may be inaccurate over time: there may always be some unexpected event catalyst that could suddenly change the basis of a strong investment thesis; Furthermore, management may have hidden significant information, or financial statements may have been manipulated.

Therefore, a successful investment search does not exclude the need for diversification of investments.

2. Investment research is a very time-consuming job. Besides the need for a tremendous amount of time, it requires multi-disciplinary expertise that people can master only after decades of experience in the field.

While Investment Research has been mostly limited to a restricted range of people specialized in the field, the results that emerge from it can be of invaluable help to all those who hold savings and wish to multiply them at a higher rate while taking lower risks.

For this reason, Gainshore was born, the only solution for people without the intention to spend time in lengthy analysis or be financially experienced.

This short advertisement video summarises what investment research is all about.